Intro

2021 was a quite the year for Solana. The SOL token 100x’d in market cap went from one of the 1000 unknown tokens to top 5! In December 2021, it had a marketcap of $53 Billion, up from $490 million in January 2021. At one point, Solana was valued more than a lot of growth stocks!

What build for Solana?

Part of the reason Solana has been so successful is due to its unique capabilities offered that separate it from the market leader — Ethereum. Here’s a look at some of the capabilities that set Solana apart and why developers are building on Solana.

Low gas fees

Ethereum’s gas prices have been all the rage in 2021 with the emergence of NFTs. Users are frequently having to spend upwards of $10 and sometimes even as high as $100 to complete transactions. This limitation was on full effect this past weekend during the release of BAYC Otherside Land Sale when Ethereum gas prices climbed as high as 2 ETH!

In contrast to Ethereum, Solana transactions cost about $0.00025!

Higher Throughput

Solana has been designed to scale to very high throughput from the ground up. Whereas, Bitcoin can 7 and Ethereum 30, Solana can handle up to 60K Transactions Per Second (TPS).

While the full 60K TPS is not in use atm, the current TPS hovers between 2000 and 3000.

Confirmation times

Solana offer sub-second finality while on Ethereum it can take from 15 seconds to 5 minutes depending on the amount of gas paid and network congestion.

The combination of higher throughput and fast confirmation times offer developers the ability to build apps that would not be possible on Ethereum. For e.g. decentralized order book exchanged like Serum.

Using Rust, C or C++ for development

Solana developers write smart contracts in Rust which is one of the fastest-growing languages, according to Github’s “The State of The Octoverse”. For Solana, Rust solves issues of memory safety and thread concurrency.

In addition, existing C or C++ developers can leverage their existing knowledge for Solana programming.

Ecosystem Grants and Advisors

Solana has a large network of VCs who offer ecosystem grants and advice on building dApps for the Solana ecosystem. Building a startup can be scary proposition as 99% of the startups end up in failure. Therefore, it helps to have an ecosystem of successful individuals you can rely on for advice as well as bootstrapping initial efforts.

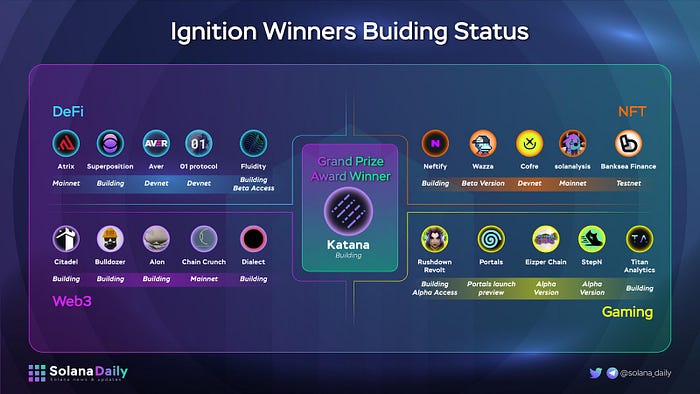

In addition, Solana regularly holds hackathons which has led to creation of many popular protocols such as Katana!

L1 Comparison

Solana is currently one of the top 5 protocols by TVL. Around the end of 2021 when SOL hit ATH, Solana was around #2 and #3 by TVL. It has a growing DeFi ecosystem of dApps. It’s only bested by another hot 2021 L1 — Avalanche and a long-time behind Ethereum — BSC. Tron is a recent entrant into the top 5 with the release of the USDD stablecoin.

Looking at the protocol revenue, Solana again shows up in the top 5. Although Ethereum is miles ahead of everyone with $8.2B generated in the last year, Solana’s revenue is comparable to other similar alt-Ethereum L1s like Avalanche.

NFT Comparison

Comparing the NFT revenue, we can see that Ethereum is the clear winner with 2 marketplaces doing more than $1B volume in the last 30 days.

However, Solana is the only non-Ethereum blockchain with any significant traction in the NFT space. Magic Eden which is the top NFT marketplace on Solana shows up on #3 spot with nearly ~$377M volume in the last 30 days.

Conclusion

2021 was a great year for Solana which made it one of the most talked about names in developer community. It put Solana in front of many developers who might not have considered it otherwise. The existing class of apps are a great showcase of what can be achieved on a blockchain like Solana with its unique value-proposition.